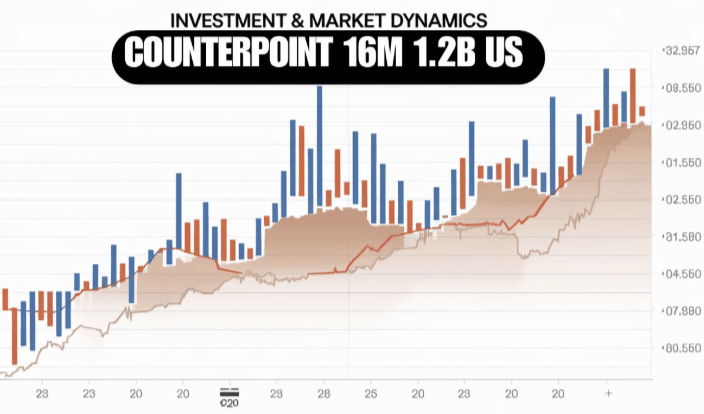

Counterpoint 16M 1.2b Financialtimes report presents a nuanced examination of the interplay between inflation, employment metrics, and consumer sentiment in today’s volatile market. By employing rigorous economic methodologies, it reveals critical insights into the shifting patterns of demand, particularly in sustainable and tech-driven sectors. As stakeholders grapple with these changes, the implications for strategic decision-making become increasingly profound. What strategies might emerge as essential for navigating this complex landscape, and how can investors adapt to ensure resilience in their portfolios? The answers may redefine traditional approaches to market engagement.

Overview of the Report

Counterpoint 16M 1.2b Financialtimes report provides a comprehensive analysis of market trends and consumer behavior within the specified sector.

The report highlights key findings through rigorous economic analysis, identifying shifts in purchasing patterns and emerging preferences.

Key Economic Indicators

Understanding the current market landscape requires a thorough examination of key economic indicators that shape consumer behavior and overall market performance.

Inflation rates significantly influence purchasing power and consumer confidence, while employment statistics reflect workforce health and economic stability.

Together, these indicators provide essential insights into economic conditions, guiding stakeholders in making informed decisions and fostering an environment conducive to growth and prosperity.

Read Also Counterpoint 1.2b Us Chinabradshaw

Market Trends and Implications

How are current market trends reshaping the economic landscape?

Increasing market volatility has prompted investors to reassess their investment strategies.

The shift towards sustainable and technology-driven sectors reflects a broader demand for resilience and adaptability.

As economic uncertainties persist, stakeholders must navigate these trends with a keen understanding of risk management, ensuring that their approaches align with evolving market dynamics and personal financial freedom.

Future Projections and Strategies

As economic conditions continue to evolve, projecting future trends and formulating effective strategies becomes essential for stakeholders seeking to navigate a landscape marked by uncertainty.

Strategic planning must prioritize future investments that align with emerging market dynamics.

Conclusion

In the shifting sands of economic dynamics, Counterpoint 16M 1.2b Financialtimes” serves as a lighthouse, illuminating the path for investors amid turbulent waters. The interplay of inflation and employment statistics weaves a complex tapestry that demands astute navigation. As the demand for sustainability and technology burgeons, stakeholders must embrace informed strategies, charting a course through uncertainty. Ultimately, the report underscores that foresight and adaptability will be the compass guiding decision-making in an ever-evolving marketplace.